Nevada Representative Dina Titus has introduced the FAIR BET Act this week. It aims to counteract the One Big Beautiful Bill’s 90% gambling loss cap. Effectively, it restores full loss deductions for gamblers.

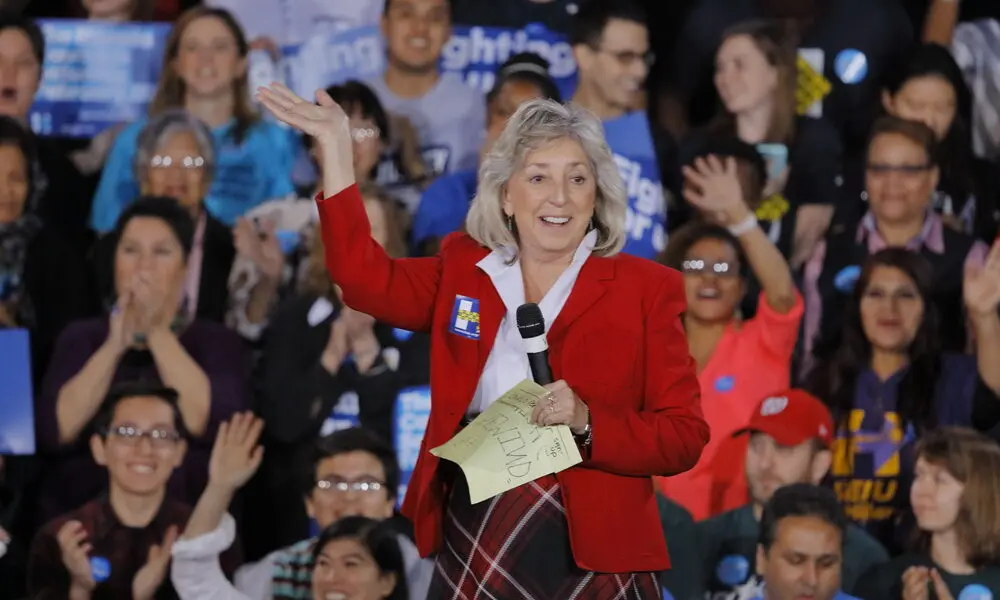

Titus, a Democrat from Nevada, filed the Fair Accounting for Income Realized from Betting Earnings Taxation Act. The bill arrives after the Senate passed the One Big Beautiful Bill late last week. That budget package limits gambling loss deductions to 90% of winnings.

In a public statement, Titus explained the impact. She said the GOP-led budget cut from 100% to 90% was without House approval. She emphasized that the FAIR BET Act “would rightfully restore the full deduction for losses so gamblers don’t pay taxes on money they haven’t won.”

The current cap could trigger taxes on players even after net losses. For instance, if someone wins and loses equally, they’d still face tax obligations. Titus added this change might push gamblers toward offshore, unregulated platforms. That scenario could harm consumer protections and tax revenue.

Support for the FAIR BET Act

Industry groups voiced immediate support. The American Gaming Association quickly backed the FAIR BET Act. They praised Titus for restoring longstanding tax treatment.

This legislation covers all forms of legal gaming activity. These include online sportsbooks, online casinos, and real money online casino offerings. It ensures both recreational and professional gamblers benefit equally.

Titus introduced the bill with California Representative Ro Khanna as co-sponsor. It will go to the House Ways and Means Committee for review next.

Critics of the One Big Beautiful Bill applaud Titus’ efforts. They believe the loss cap could unintentionally hinder legal gambling growth. With this move, they urge Congress to act swiftly.

As the FAIR BET Act advances, both lawmakers and industry leaders will monitor its progress closely. Nevada’s representative remains hopeful it will reinstate fair treatment for bettors nationwide.

Potential Effects on Online Casinos

The FAIR BET Act could boost online casinos by restoring fair tax treatment for gamblers. This encourages more players to stay on legal platforms. Additionally, the bill supports responsible gambling by keeping players within regulated systems.

Real money online casino operators may see increased activity and trust from users. As a result, state tax revenues from online casinos could rise steadily. Moreover, players can deduct full losses, making real money online casino play more financially manageable. This bill also discourages offshore gambling alternatives.

Overall, the FAIR BET Act strengthens industry stability and helps online casinos grow in a safer, more transparent environment.